south dakota property tax exemption

Article XI 5 provides a. For additional information on sales tax please refer to our Sales Tax Guide PDF.

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Exempt property but is not completely accurate due to inconsistencies in the manner in which the property is valued and reported.

. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Not all states allow all exemptions listed on this form. Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes.

South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. Andys Restaurant provides an exemption certificate to the wholesaler to purchase these products exempt from sales tax. Under South Dakota law Andy is the user of the paper products and does not.

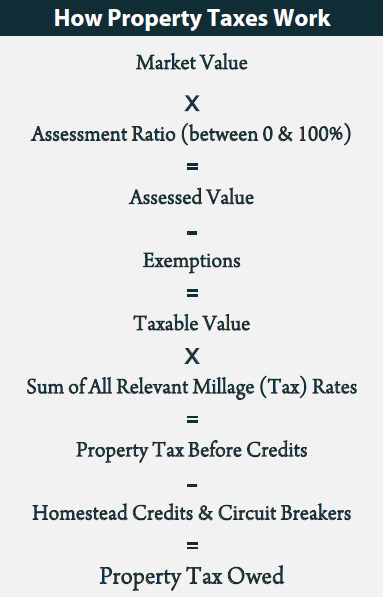

Exempts up to 150000 of the assessed value for qualifying property. 128 of home value. There are two sections in the South Dakota Constitution that provide property tax exemptions.

South Dakota offers a full property tax exemption to eligible paraplegic Veterans and their Surviving Spouse. Ad Fill Sign Email EForm-1932 More Fillable Forms Register and Subscribe Now. South Dakota is ranked number twenty seven out of the.

Wind solar biomass hydrogen hydroelectric and geothermal systems used to produce electricity or energy are considered renewable resource systems. The state gets a good amount of sun throughout the year and solar panel module prices continue to fall. All sales of tangible personal property and services are subject to the state sales tax plus applicable municipal tax unless exempt from.

This information is intended to provide guidance in response to commonly asked questions by taxpayers and members of the public. Partial exemption of dwellings owned by certain disabled veterans. Certification of Contractor Owner Occupied Dwelling PT3002.

The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax SDCL 10-4-42 to 10-4-45. It does not address all aspects of property taxes. The continuous exemption applies to the first 50000 or 70.

Public schools including K-12 universities and technical institutes that are supported by the State of South Dakota or. Additionally the disability has to be complete and 100 related to military service. Purchasers are responsible for knowing if they qualify to claim exemption from tax in.

The property must be owned and occupied by a disabled veteran. Download or Email EForm-1932 More Fillable Forms Register and Subscribe Now. This exemption applies to the house garage and the lot up to one acre.

Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing and needs no statutory language to put the. State of South Dakota and public or municipal corporations of the State of South Dakota. The property has to be their principal residence.

Eligible waterways are determined by the Department of Agriculture and Natural Resources with additional waterways as allowed by the county commission. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Disabled Veteran Property Tax Exemption PT46C.

Summary of South Dakota solar incentives 2022. Applications for these reductions or exemptions can be obtained from and returned to this office or can also be obtained at the SD Department of Revenues links below. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser.

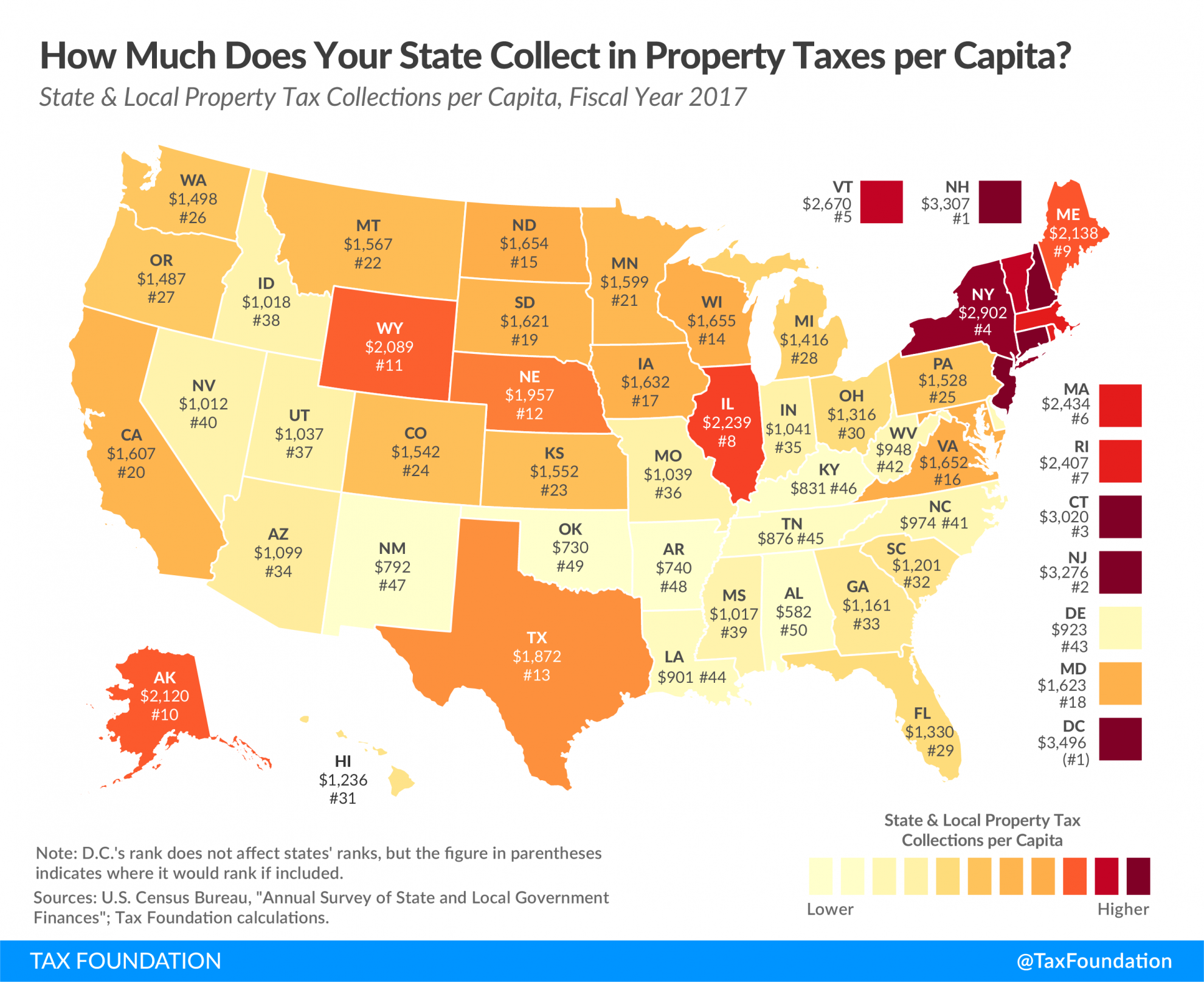

Tax amount varies by county. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. FAQs - Property Taxes - Pennington County South Dakota.

One hundred fifty thousand dollars of the full and true value of the total amount of a dwelling or portion thereof classified as owner-occupied pursuant to 10-13-39 to 10-13-404 inclusive that is owned and occupied by a veteran who is rated as permanently and totally disabled from a. Constitutional Provisions There are two sections in the South Dakota Constitution that provide property tax exemptions. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

The unmarried spouse of an eligible veteran. For additional information please contact the Treasurers Office at 605-394-2163. Certification Owner Occupied Dwelling PT3001.

SDCL 10-4-2410 SDCL 10-4-2411. The state sales and use tax rate is 45. The property subject to this exemption is the same property eligible for the owner-occupied classification To be eligible.

This is a multi-state form. FAQs - Property Taxes. There are about 5800 parcels of exempt property listed in the table.

South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. South Dakota property tax credit.

South Dakota Property Tax Exemption for Paraplegic Veterans and Their Surviving Spouse. South Dakota is a decent place to install home solar panels but not due much to the effort of state lawmakers here outside of a property tax exemption.

/cloudfront-us-east-1.images.arcpublishing.com/gray/QU6AHKTDPFKBFGKQGGGUVF5UEU.jpg)

Sales And Property Tax Refund Program Open To Senior Citizens And Citizens With Disabilities

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020

Property Tax Definition Property Taxes Explained Taxedu

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Which States Have The Lowest Property Taxes

Property Tax Definition Property Taxes Explained Taxedu

Here Are The Most Tax Friendly States For Retirees

These 7 U S States Have No Income Tax The Motley Fool

Op Ed Truth In Taxation Is Necessary For Iowa Property Tax Relief Iowa Thecentersquare Com

Department Of Revenue Reminds Homeowners Of The Upcoming Owner Occupied Property Tax Relief Deadline South Dakota Department Of Revenue

Map State Sales Taxes And Clothing Exemptions Tax Foundation