opening work in process inventory formula

How do I account for work in progress inventory. Abnormal gain- Physical units 100 complete.

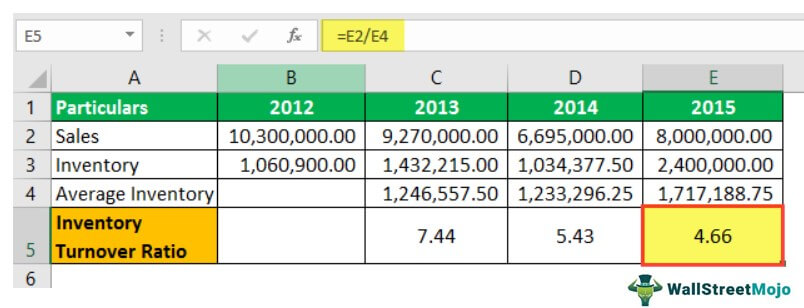

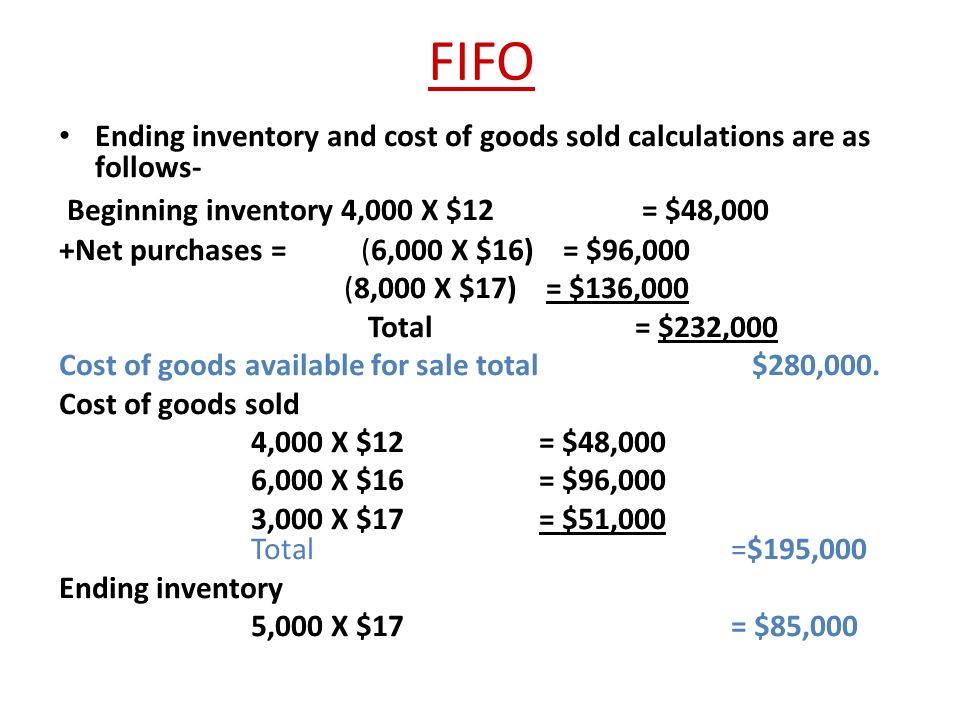

Inventory Ratio Definition Formula Step By Step Calculation

Opening Inventory Closing Inventory 10000 5000 5000 which is your cost of sales.

. Take a look at how it looks in the formula. Its ending work in process is. Work-in-process is a companys partially finished goods waiting for completion and eventual sale or the value of these items.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory 200000 150000 125000 225000 Your ending WIP inventory would be 225000 for. Work-in-Process Inventory Formula.

Once you know your beginning WIP inventory manufacturing costs and COGM you can start to use the WIP inventory formula. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

Every dollar invested in unsold inventory represents risk. Work In-process Inventory Example. Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. The value of that partially. 10000 300000 250000 60000.

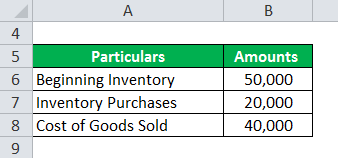

During the remaining financial year the company has made purchases amounting 20000 and during that time on the companys income statement the cost of goods sold is 40000. Work in process inventory 60000. The term is used in production and supply chain management.

Assume Company A manufactures perfume. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory. Your WIP inventory formula would look like this.

Beginning WIP Inventory Production Costs Finished Goods Ending WIP Inventory. Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which the others are raw materials and finished goods. 4000 Ending WIP.

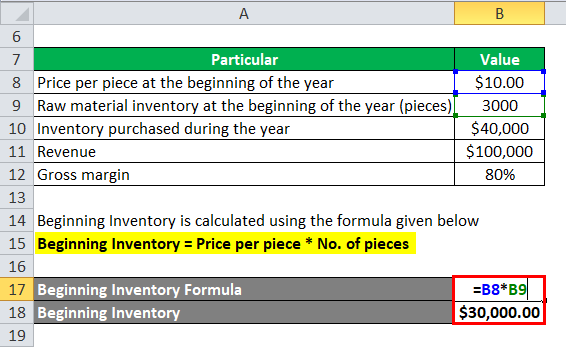

Formulas to Calculate Work in Process. Let say company A has an opening inventory balance of 50000 for the month of July. The formula for calculating the WIP inventory is.

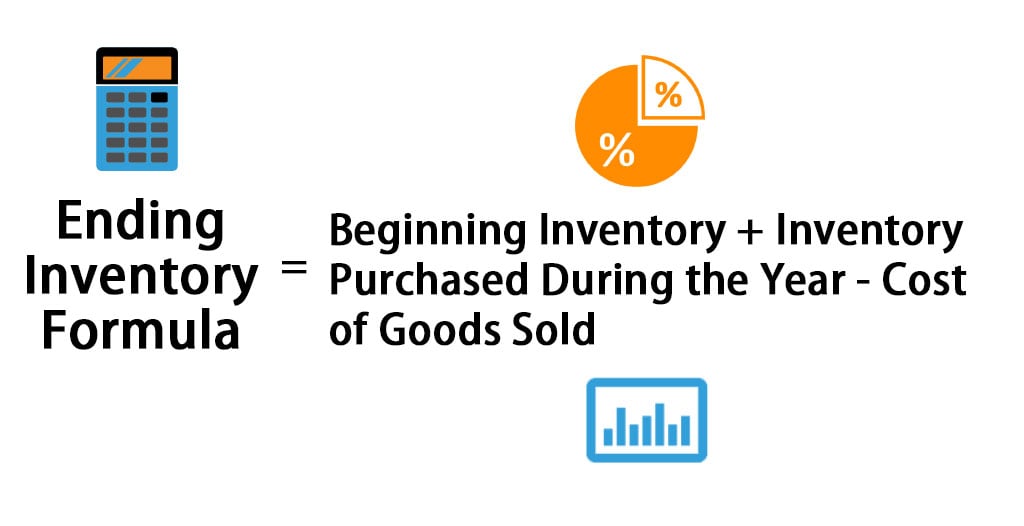

Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods. Ending inventory Previous accounting period beginning inventory Net.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Therefore the formula to calculate the Work in Process WIP is. Work in process inventory formula.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Below is the data table. COGS Previous accounting period beginning inventory previous accounting period purchases previous accounting period ending inventory.

Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods Ending WIP Inventory. Work in process inventory formula. Do the same with the amount of new inventory.

The work in process inventory formula consists of the ending work inventory for that period and the beginning work inventory for the next one. Multiply your ending inventory balance by the production cost of each inventory item. COGS Previous accounting period beginning inventory previous accounting period purchases previous accounting period ending.

Your WIP inventory formula would look like this. Keep in mind this value is only an estimate. It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area.

The last quarters ending work in process inventory stands at 10000. Once you have all three of these variables the formula for calculating WIP inventory is. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have.

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done. 10000 300000 250000 60000 Work in process inventory 60000 The WIP figure indicates your company has. The WIP figure reflects only the value of those products in some intermediate production stage.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. If your head is spinning with all these figures dont worry. Heres how youll need to do it.

Works in process WIP are included in the inventory line item as an asset on your balance sheet. Under this method the cost of completed units is calculated by multiplying production expressed in terms of equivalent units. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have.

Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this. Inventory Formula Example 1. An important note to consider is that work in process inventory can vary greatly.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. CIQA is a quality and regulatory consultant with 25 years of experience developing products and managing projects in the medical device supply chain and pharmaceutical industries. Abnormal loss- Physical units produced are multiplied by the degree of completion.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. To calculate your in-process inventory the following WIP inventory formula is followed.

5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured. Work-in-process WIP refers to a component of a companys inventory that is partially completed. The formula is.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory.

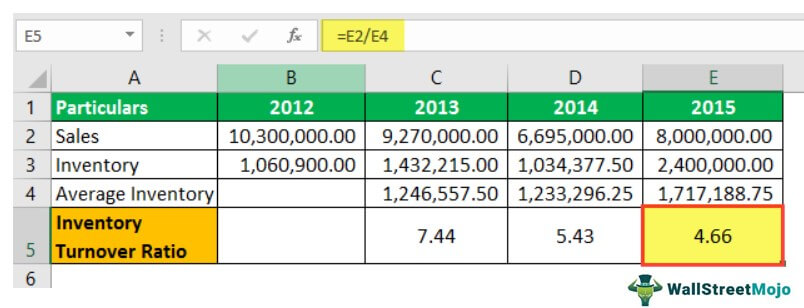

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

Wip Inventory Definition Examples Of Work In Progress Inventory

Inventory Formula Inventory Calculator Excel Template

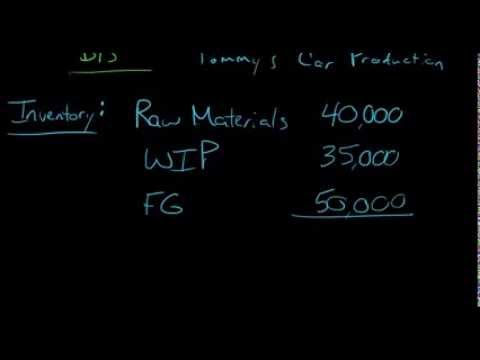

How To Calculate Ending Inventory Using Absorption Costing Online Accounting

Manufacturing Account Format Double Entry Bookkeeping

Average Inventory Formula How To Calculate With Examples

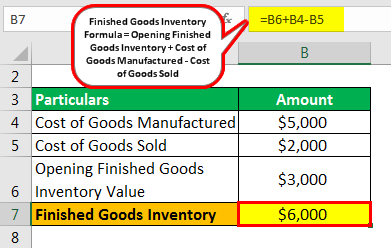

Finished Goods Inventory How To Calculate Finished Goods Inventory

How To Calculate Finished Goods Inventory

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

What Is Work In Process Wip Inventory How To Calculate It Ware2go

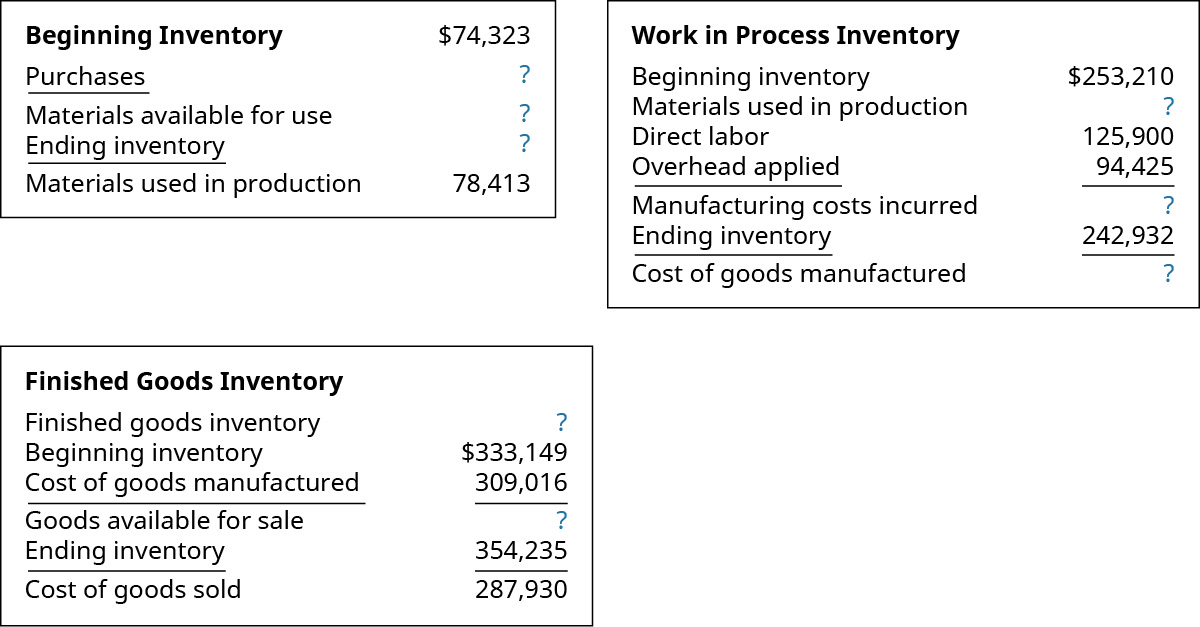

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Operating Cycle Formula Step By Step Calculation Examples

Inventory Formula Inventory Calculator Excel Template

Work In Process Wip Inventory Youtube

Ending Inventory Formula Calculator Excel Template

Ending Inventory Formula Calculator Excel Template

Ending Work In Process Double Entry Bookkeeping

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template