inheritance tax waiver form florida

AS REVISED IN 1968 AND SUBSEQUENTLY AMENDED. C All qualified tuition programs authorized by s.

Only tax year 2019 and 2020 Forms 1040 and 1040-SR returns that were originally e-filed can be amended electronically.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. In Florida the court considers any money that either spouse puts into a retirement plan like a 401k or an IRA as marital propertyThus the court splits up retirement plans the same way it divides other marital assets. For eligibility refer to Form 12277 Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal Revenue Code Section 6323j PDF and the video Lien Notice Withdrawal. Type of federal return filed is based on your personal tax situation and IRS rules.

Confinement waiver available on or after the first contract anniversary after the owner is confined for at least 60 consecutive days. Bankruptcy exemptions describe the personal and real property a bankruptcy debtor may keep through the bankruptcy process and retain after the bankruptcy. This is the option with the highest tax consequences for the beneficiary.

You can now submit the Form 1040-X Amended US. This option makes it less likely that the beneficiary will fall into a different tax bracket. 529 of the Internal Revenue Code of 1986 as amended including but not limited to the Florida Prepaid College Trust Fund advance payment contracts under s.

401k and IRA and Divorce in Florida. At that time he will owe taxes only on the increased value of the portion that is withdrawn in the year. Withdrawals of earnings are subject to current income tax and if made prior to age 59½ may also be subject to a 10 federal income tax penalty.

Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. Florida Bankruptcy Exemptions from Creditors. Individual Income Tax Return electronically using available tax software products.

An essential concept in Chapter 7 bankruptcy is exemptions or exempt property. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. One important thing to note is that the court only considers retirement or pension funds accrued during the.

The beneficiary can also withdraw the money over a period of five years. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

The Constitution of the State of Florida as revised in 1968 consisted of certain revised articles as proposed by three joint resolutions which were adopted during the special session of June 24-July 3 1968 and ratified by the electorate on November 5 1968 together with one. 100998 and the Florida Prepaid College Trust Fund participation agreements under s. As soon as a debtor files Chapter 7 bankruptcy in Florida a Chapter 7 trustee.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation.

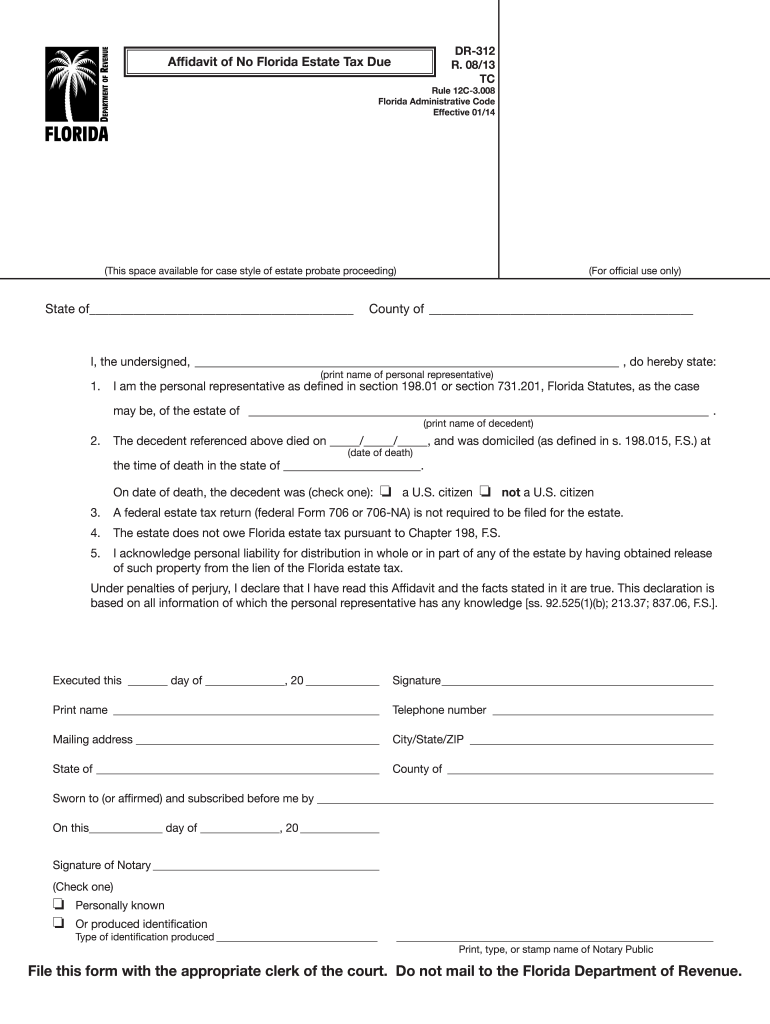

Dr 312 Fill Out And Sign Printable Pdf Template Signnow

2018 2022 Form Fl Dor Dr 405 Fill Online Printable Fillable Blank Pdffiller

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Lease Lease Agreement Templates

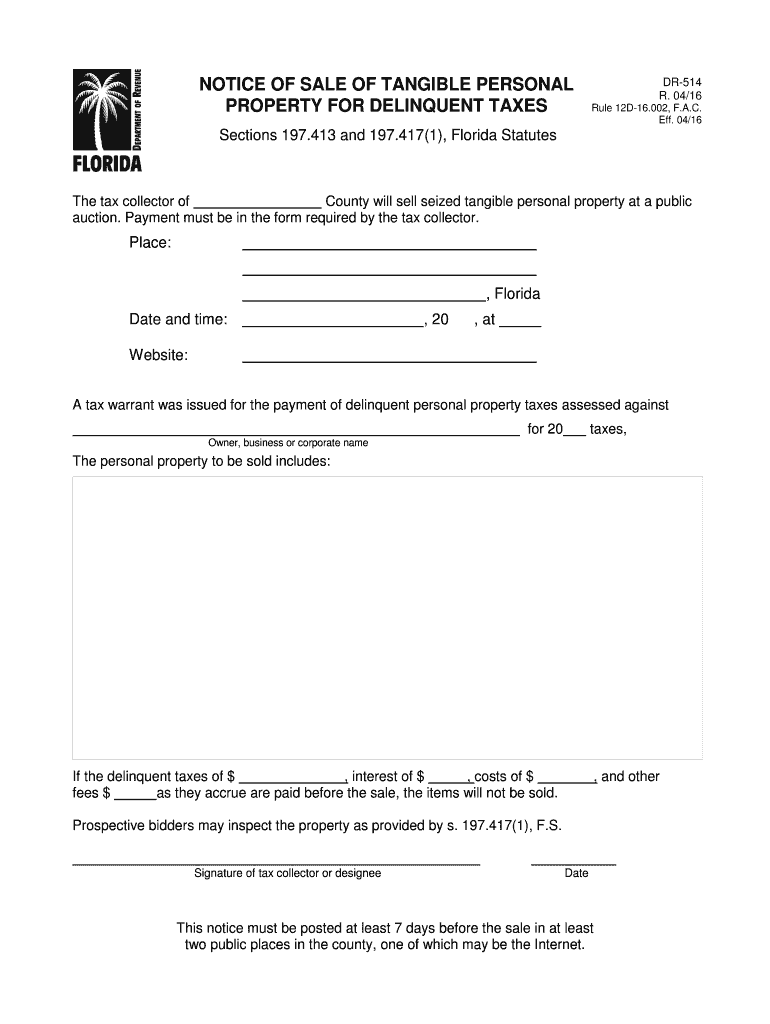

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

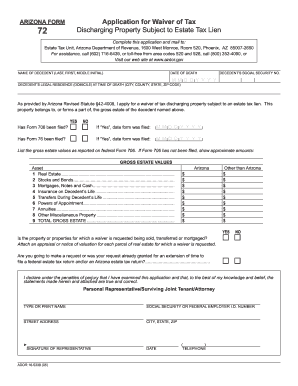

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

State W 4 Form Detailed Withholding Forms By State Chart

Canadian Doesn T Need To Provide W 9 To United States W9 Form Com

3 11 3 Individual Income Tax Returns Internal Revenue Service

New York Residential Lease Agreement Form Lease Agreement Legal Forms Rental Application

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Get And Sign Arizona Inheritance Tax Waiver Form

L9 Form Fill Online Printable Fillable Blank Pdffiller

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

2019 Form Fl F 1120a Fill Online Printable Fillable Blank Pdffiller